Business Miles Deduction 2025

Business Miles Deduction 2025. 22 cents per mile driven for medical or moving purposes. Irs mileage rates for 2023.

If you use your car for business, charity, medical or moving purposes, you may be able to take a deduction based on the mileage used for that purpose. You can still claim this deduction if you.

14 Cents Per Mile Driven In.

Along with those listed above, there are other common deductions that will be effected in 2025 if left unchanged.

Apply That Percentage To Actual.

Whether someone travels for work once a year or once a month, figuring out.

Whenever You Drive For Business, Medical Reasons, Or In Support Of A Charitable Organization, You May Be Able To Get A Mileage Deduction And Save Money.

Images References :

Source: www.finansdirekt24.se

Source: www.finansdirekt24.se

Business Mileage Deduction 101 How to Calculate for Taxes, Qualified business income deduction (qbi) one. However, if you use the car for both business and personal purposes, you may deduct only the cost of its business use.

Source: xworld.org

Source: xworld.org

Two Ways to Calculate IRS Miles Deduction X World, Per irs guidance, depreciation benefits will be 60% in 2024, 40% in 2025, and 20% in 2026. The new tax law eliminates this break for most.

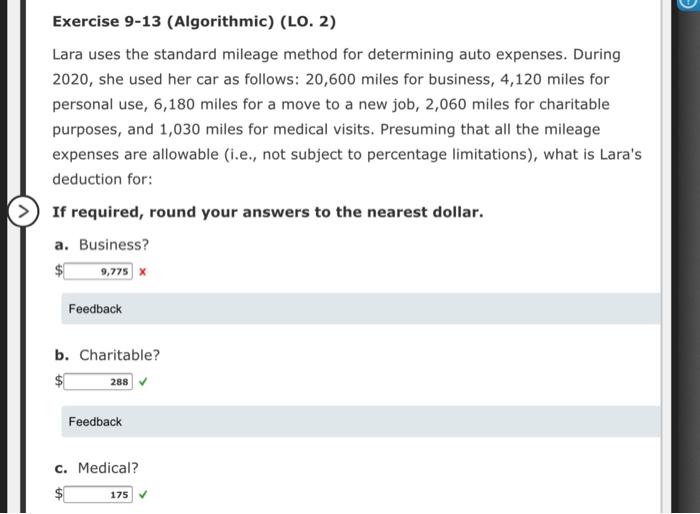

Source: www.chegg.com

Source: www.chegg.com

Solved Exercise 913 (Algorithmic) (LO. 2) Lara uses the, Whether someone travels for work once a year or once a month, figuring out. Updated on december 21, 2022.

Source: jrosiotax.com

Source: jrosiotax.com

IRS Business Mileage Deduction Requirements J. Rosio Tax Services, The tcja eliminates the deduction for unreimbursed employee business expenses for tax years 2018 through 2025. You can generally figure the amount of.

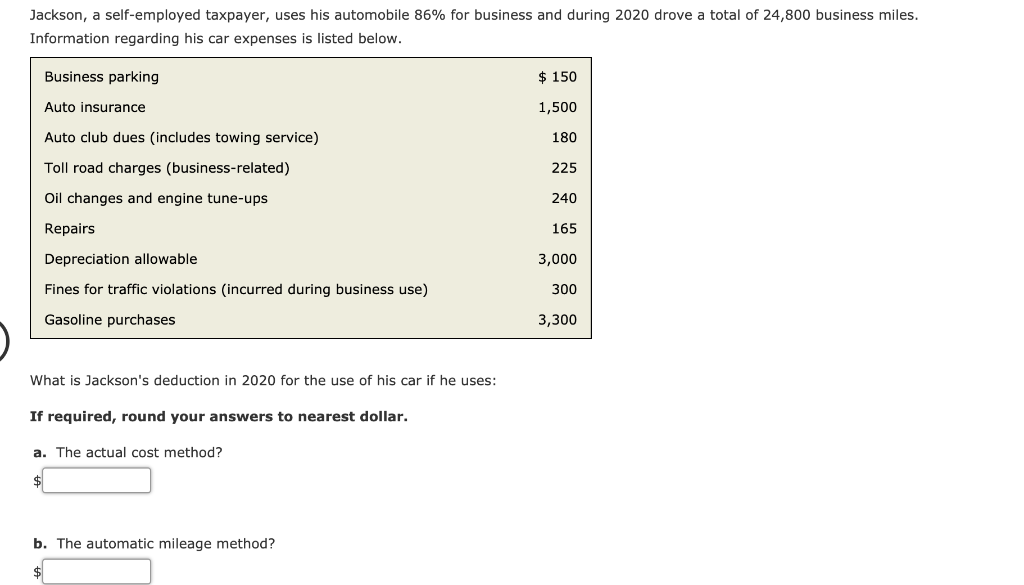

Source: www.chegg.com

Source: www.chegg.com

Solved Jackson, a selfemployed taxpayer, uses his, You can still claim this deduction if you. Whether someone travels for work once a year or once a month, figuring out.

Mileage Tax Deduction for SelfEmployed Formations, If you use your car for business, charity, medical or moving purposes, you may be able to take a deduction based on the mileage used for that purpose. The irs has established a set.

Source: crspconnect.com

Source: crspconnect.com

Business Mileage Rates play a cardinal role in tax deduction, If you use your car for business, charity, medical or moving purposes, you may be able to take a deduction based on the mileage used for that purpose. 67 cents per mile driven for business use (1.5 cent.

Source: www.pinterest.com

Source: www.pinterest.com

Mileage Tax Deduction How To Write Off Miles For Taxes Mileage, Along with those listed above, there are other common deductions that will be effected in 2025 if left unchanged. You can still claim this deduction if you.

Source: www.taxoutreach.org

Source: www.taxoutreach.org

How to Claim the Standard Mileage Deduction Get It Back, You can generally figure the amount of. When you use your personal vehicle for business purposes, many employers will reimburse you per mile with mileage allowance payments (map).

Source: www.pinterest.com

Source: www.pinterest.com

STANDARD MILEAGE RATE VS. ACTUAL VEHICLE EXPENSE DEDUCTION ON YOUR, The tcja eliminates the deduction for unreimbursed employee business expenses for tax years 2018 through 2025. Qualified business income deduction (qbi) one.

946 For Official Guidance Around 179 Depreciation Rules.

Along with those listed above, there are other common deductions that will be effected in 2025 if left unchanged.

You May Also Be Able To Claim A Tax Deduction For Mileage In A.

The 2023 standard mileage rate increased by 3 cents to 65.5 cents per mile.